Tag: interest rates

-

US Federal Reserve Holds Interest Rates Steady, Sparking Criticism from Trump

The US Federal Reserve has decided to pause on rate cuts, a move that has notably displeased President Trump. This decision comes amid ongoing discussions about the state of the U.S. economy and monetary policy. The Federal Reserve’s stance aims to evaluate the impact of previous rate adjustments before making further changes. This cautious approach,…

-

Exploring Trump’s Potential Influence on Federal Reserve Rate Decisions

The video delves into the extent of influence former President Donald Trump can wield over decisions regarding rate cuts and the Federal Reserve’s monetary policy. It outlines the historical context of presidential influence over the Fed, Trump’s public statements concerning rate cuts, and how these might affect the Fed’s independence and decision-making process. The content…

-

Analyzing Trump’s Potential Influence on Inflation Control

The video explores the extent of influence that former President Donald Trump might have on controlling inflation, analyzing the limits and capabilities within the political and economic frameworks. It delves into the mechanisms of inflation control, the role of government policies, and how these interplay with other economic factors and entities like the Federal Reserve.…

-

Comparing Trump and Harris’s Strategies to Address the Housing Crisis

In a recent analysis, the contrasting approaches of Donald Trump and Kamala Harris to solving the housing crisis were discussed. The video delves into their respective policies and strategies, highlighting how each proposes to address the ongoing challenges within the housing sector. This comparison sheds light on the broader implications of their approaches for the…

-

Exploring the Implications of Proposed ‘Billionaire’ Minimum Tax by Harris on America’s Ultra-Rich

The proposed ‘Billionaire’ Minimum Tax, as outlined in the recent Wall Street Journal analysis, aims to impose a new tax regime on America’s wealthiest individuals. This initiative, pushed forward by the administration, seeks to ensure that the ultra-rich contribute a fair share to the nation’s revenue through a minimum tax rate. The discussion revolves around…

-

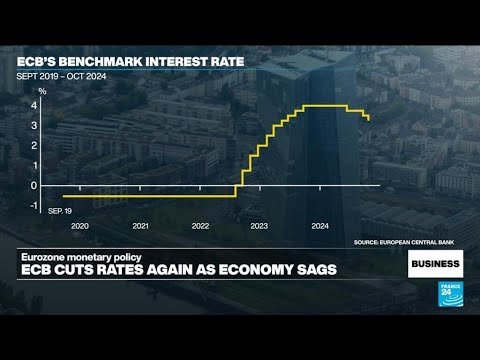

ECB Announces Further Interest Rate Cuts Amid Stagnant Eurozone Growth

In response to ongoing sluggish growth within the Eurozone, the European Central Bank (ECB) has decided to implement another cut in interest rates. This decision aims to stimulate economic activity by making borrowing cheaper for businesses and consumers alike, in hopes of countering the persistently low inflation rates and boosting the overall economic growth across…

-

EU to Impose Tariffs of Up to 38% on Chinese Electric Vehicles Amid Subsidy Concerns

In a significant move that could escalate tensions between the European Union and China, the EU has informed China of its decision to impose import duties of up to 38% on Chinese-made electric vehicles (EVs) starting July 4th. This decision comes after the European Commission accused China of flooding the EU market with cheaply subsidized…

-

Bitcoin Hits New Record High Amid Market Changes and Wall Street’s Crypto Embrace

Bitcoin has hit new record highs, significantly outperforming its 2021 rally, with a current value that dwarfs the 2019 investment return by 1700%. This surge is underpinned by a combination of settled inflation, increased consumer spending, technological advancements, particularly in AI, and a more stable economic environment, contrasting sharply with the conditions of the 2021…

-

Examining the Feasibility of a Soft Landing Amid Economic Challenges and Fed Policy Adjustments

The Wall Street Journal examines the concept of a soft landing in economics, highlighting how the Federal Reserve aims to achieve a delicate balance of lowering inflation without triggering a recession or a significant rise in unemployment. The video explains the rarity and difficulty of soft landings, primarily due to the unpredictable nature of the…

-

Fed Signals Hold on Interest Rates, Projects Cuts in 2024 Amid Economic Uncertainty

The Federal Reserve has opted to maintain its current policy interest rate, signaling a pause in rate hikes and indicating potential cuts in 2024. This decision reflects the central bank’s ongoing commitment to achieving its dual mandate of maximum employment and price stability. Despite inflation easing from prior highs, the Fed stresses that the path…

-

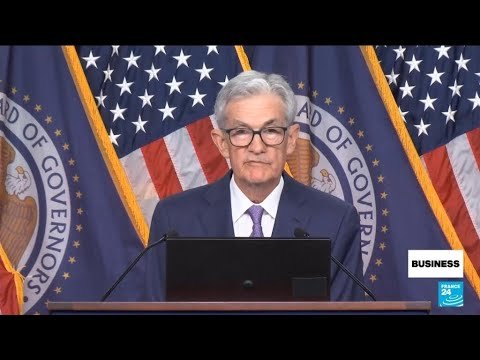

Jerome Powell Announces 0.25-Percent Interest Rate Hike, Signals Beginning of Disinflationary Process

In a significant monetary policy announcement, Jerome Powell, the Chair of the Federal Reserve, declared the initiation of a disinflationary process, accompanied by a modest interest rate hike of 0.25 percent. This move signals a cautious approach towards stabilizing the economy while addressing inflation concerns. The Wall Street Journal is an American business and economic-focused…

-

Investors Skeptical of Fed’s Inflation Plan Despite Projected Interest Rate Hikes

Investors are showing skepticism towards the Federal Reserve’s (Fed) plans to raise U.S. interest rates by approximately one percent and maintain them until at least the end of 2023. This sentiment is reflected in the trading patterns observed in the Fed Funds Futures Market on the Chicago Mercantile Exchange, indicating a belief that the actual…

-

Exploring the Impact of Derivatives on the U.K. Bond Market Turmoil

Recent financial turbulence in the U.K. bond market has been attributed to the use of derivatives and leverage by investors, according to a video analysis by the Wall Street Journal. After the British government announced tax cuts aimed at economic growth, a sell-off in government bonds ensued, which was exacerbated by derivative contracts such as…